DIFFERENT WAYS POTENTIAL HOMEBUYERS ARE MANAGING HIGHER HOUSING COSTS

April 15, 2024

One of the biggest issues facing Americans today is the rising cost of housing. Using data presented at our recent Market Intelligence Webinar by Ali Wolf, chief economist at Zonda, we take a look how different groups of people are making choices to handle the current housing market.

ENTRY-LEVEL MEANS SOMETHING DIFFERENT TODAY

Entry-level homes represent a critical segment of the housing market, and Zonda regularly hears builders say they want to pivot toward entry-level housing and the lower price point that comes with it. Because of the lower price point, the pool of potential buyers is generally higher.

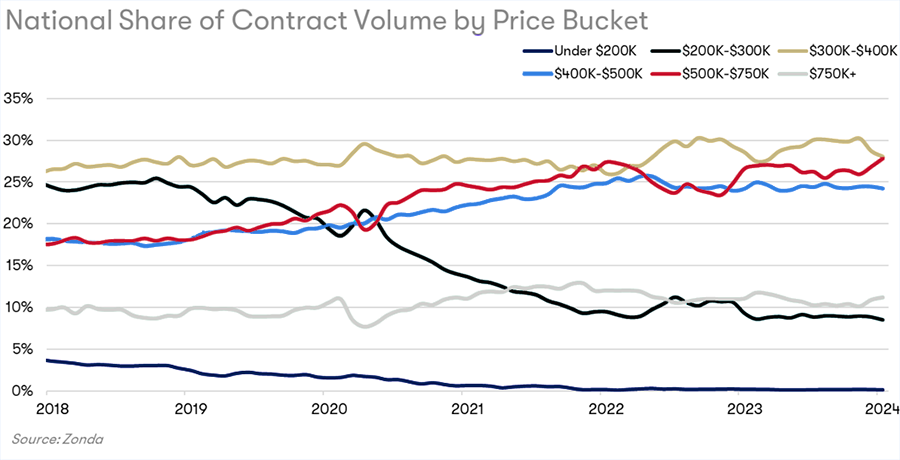

Sales rates (sales adjusted for supply) for entry-level homes are up 18% compared to pre-pandemic, which is great, but move-up sales are up 40% and high-end sales are up 35%. This is partly due to simply what is available in the market. In 2018, the largest share of total sales and supply was in the $300k-$400k price point and then $200k-$300k, which represented about 50% of the market.

However, in 2024, that $300k-$400k price point is joined by $500k-$750k as the top two price buckets, representing over 50% of the market. The $200k-$300k market has dropped to below 10%. Those looking to buy an entry-level home typically purchase using income more so than wealth, so the rising home prices create significant challenges for those looking to become homeowners.

Individuals and families are increasingly exploring varied strategies to manage affordability. These include:

- Downsizing to Smaller Homes: Many are choosing smaller, more affordable homes, sacrificing space for better financial management.

- Investing in Fixer-Uppers: Purchasing homes that require renovations has become a popular option, allowing buyers to gradually invest in improvements and potentially increase the home's value.

- Seeking More Affordable Regions: A significant number of people are relocating to suburbs or less expensive cities to find better housing values.

- Long-Term Renting: Facing the high upfront costs of buying, many are opting for long-term renting as a more feasible option, particularly where rent control laws make it economically sensible.

- Multi-Generational Living: Combining resources with family members in multi-generational homes is on the rise, helping to distribute the financial burden.

These strategies reflect a broader adaptation to economic realities, where flexibility and practicality in housing choices are becoming essential.

DIVERSE REGIONAL DYNAMICS

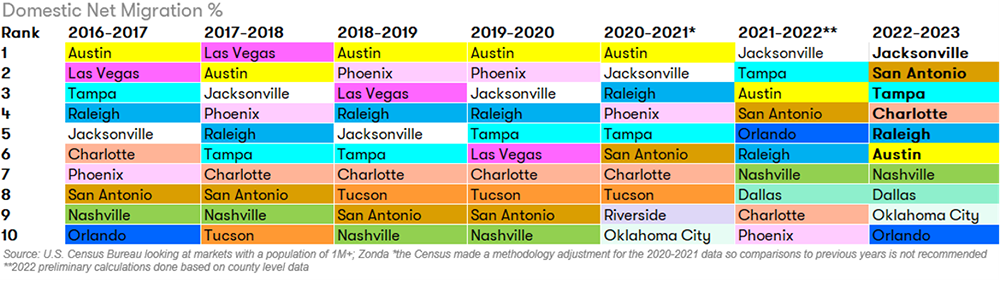

The relocation data supports this. Pre-pandemic, the states with the largest percentage of population growth were western states: Idaho, Arizona, Nevada, Utah and Texas. In 2023, there has been a distinct shift toward the southeast. South Carolina and Florida now top the list, followed by Idaho and Texas, and North Carolina rounds out the top five.

In terms of local migration, Las Vegas, Phoenix and Austin were regularly at or near the top of the cities with highest migration numbers. Last year, Phoenix and Las Vegas didn’t make the top ten and Austin came in sixth. Jacksonville, San Antonio, Tampa, Charlotte and Raleigh were the top five.

Regions experiencing significant population growth, like many areas in the Sun Belt, are seeing particularly high demand for entry-level properties, which often sell quickly due to competitive pricing and limited inventory.

HOMEOWNERS' WILLINGNESS TO COMPROMISE IN A SHIFTING MARKET

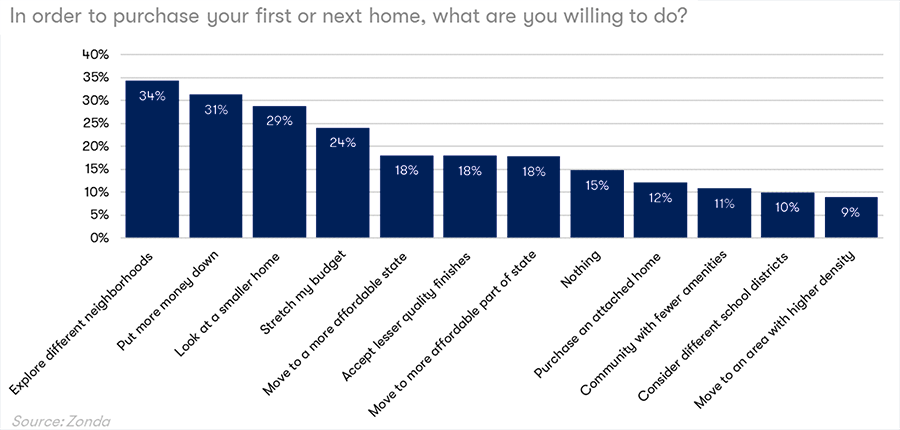

Of course, moving to a new city isn’t something everyone can do, or wants to do. Many homebuyers stay in the same city, but as the housing market adjusts to new realities, people are showing an increased willingness to compromise on certain aspects of their next home. Factors such as location, size, and specific amenities are being reconsidered in favor of affordability and overall value.

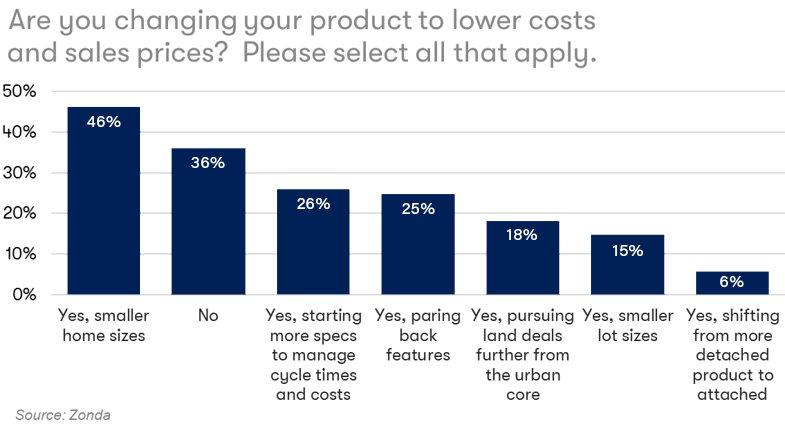

This shift is particularly noticeable among first-time buyers who prioritize essential features and favorable financing conditions over luxury or ideal specifications. To accommodate these needs, some builders are paring back features and starting more spec houses. Building smaller, quick move-in homes not only help address consumer desire, but they also help manage cycle time and costs.

THE REMODELING WAVE

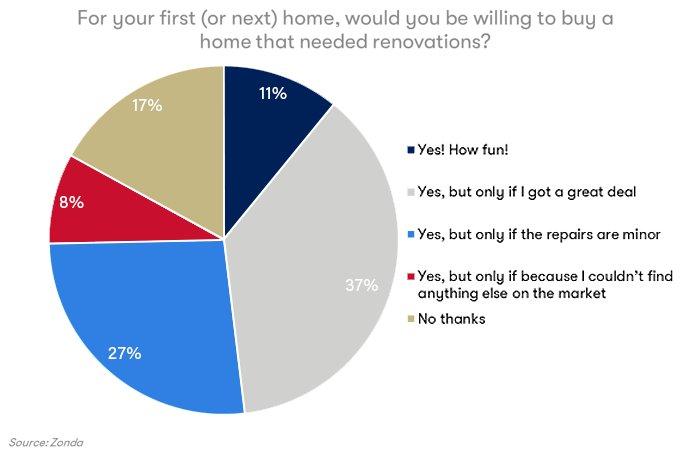

People who don’t want to move or buy a smaller, newer home may be more likely to buy a home that has existing maintenance issues to address, especially if they feel like they’re getting a great deal. A vast majority of potential homebuyers - 83% - said they would be willing to buy a home that needed renovations.

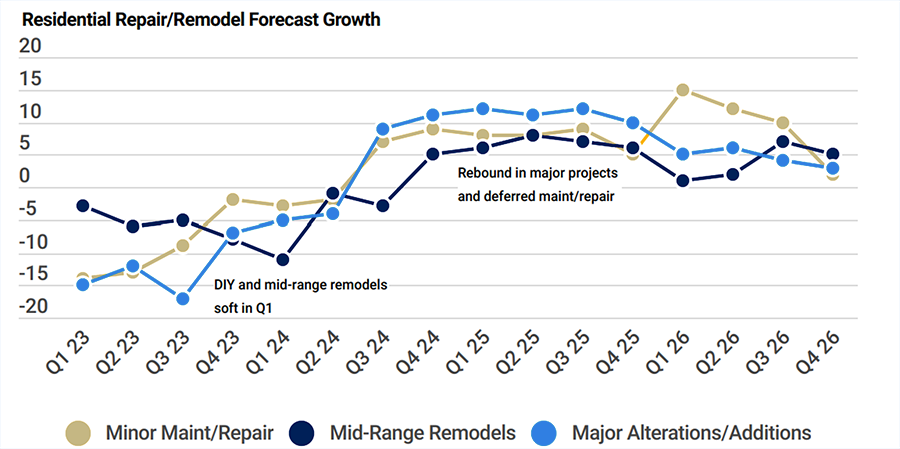

Homes between 20 and 40 years old are said to be in their prime remodeling years, and Zonda forecasts that through 2026, there will be an unprecedented level of homes getting into that age range. It’s been called a “Golden Decade” for remodeling.

RENTING AND MULTI-FAMILY CONSTRUCTION

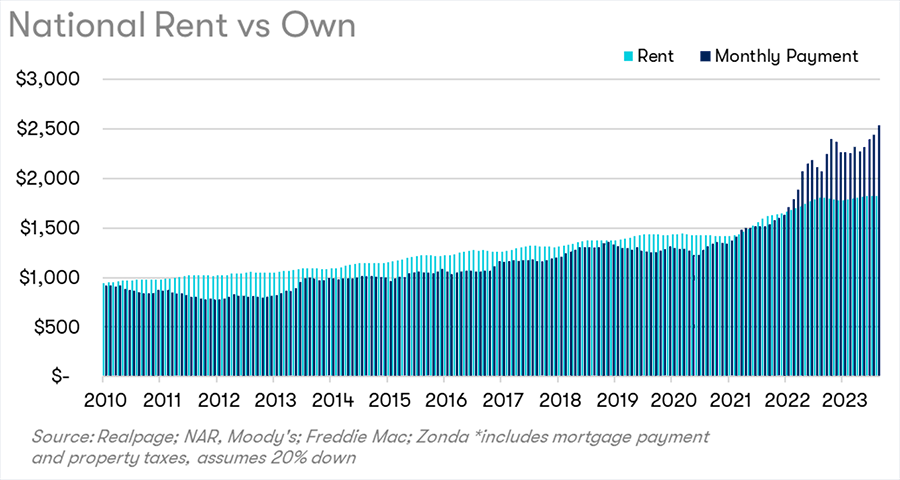

The monthly cost of rent versus a mortgage payment varies greatly by market, but nationally, over the last couple of years, mortgage payments are becoming more expensive than monthly rent payments. This has helped many in the marketplace choose to stay in a rental property versus spending more money on a mortgage.

Nationally, rents are flat to down over the last couple of years after seeing a big jump of 25% on average since the beginning of the pandemic. When analyzed by market, there are clear regional trends.

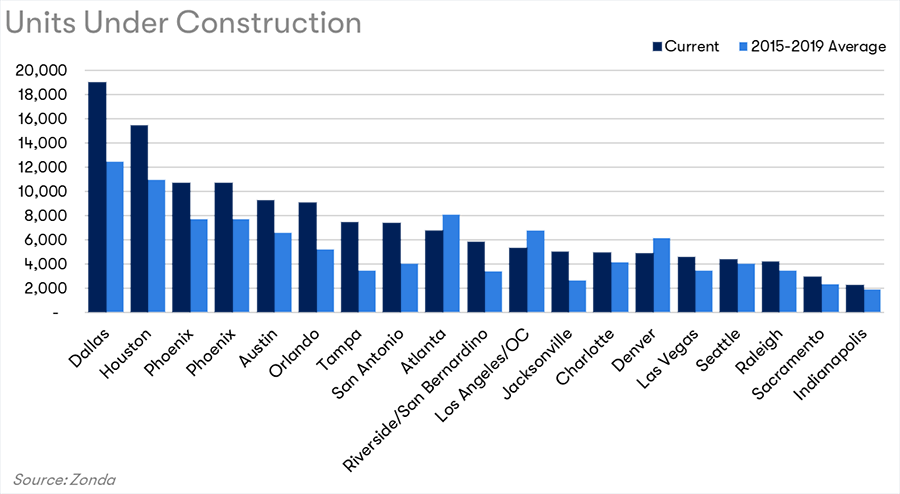

The markets where we’re seeing the biggest drops in rent are Austin, Jacksonville, Atlanta, Phoenix and Orlando. These are also the markets seeing the most migration and have strong labor markets.

There is also more supply coming to these markets. In more established markets, such as Boston, Chicago, Washington D.C., New York and California, it’s very difficult to build more multi-family housing. In Texas and Florida in particular, there is much stronger than normal rental construction.

According to Wolf, there is a sentiment that rental products were undersupplied in a select group of markets, and there is also fear of oversupply in other markets, but then it could very well revert back to undersupply as we get toward 2026 and beyond.

UNDERSTANDING AND ADAPTING TO MARKET TRENDS

As the housing market continues to evolve, understanding these diverse trends is crucial for navigating its complexities. Whether it's deciding between renting and owning, investing in an entry-level home, or choosing to remodel, the dynamics of regional differences, economic conditions, and consumer preferences play a pivotal role in shaping decisions.

Stay tuned for more housing market data in upcoming Market Intelligence Webinars from BFS and Zonda.